Have you noticed your grocery bills creeping higher? Or perhaps the cost of filling up your car seems significantly more expensive than it did just a few months ago? You’re not alone. Global inflation is a pressing issue affecting individuals and families worldwide, subtly altering the landscape of our daily routines and financial well-being. Understanding how inflation impacts our lives is the first step towards adapting and mitigating its effects.

Key Takeaways:

- Inflation directly increases the cost of everyday goods and services, impacting household budgets.

- Rising interest rates, a common response to inflation, can affect borrowing costs for mortgages and loans.

- Strategic budgeting and financial planning are crucial for managing the inflation impact.

- Understanding the factors driving inflation empowers consumers to make informed decisions.

How Rising Food Prices Reflect the Inflation Impact

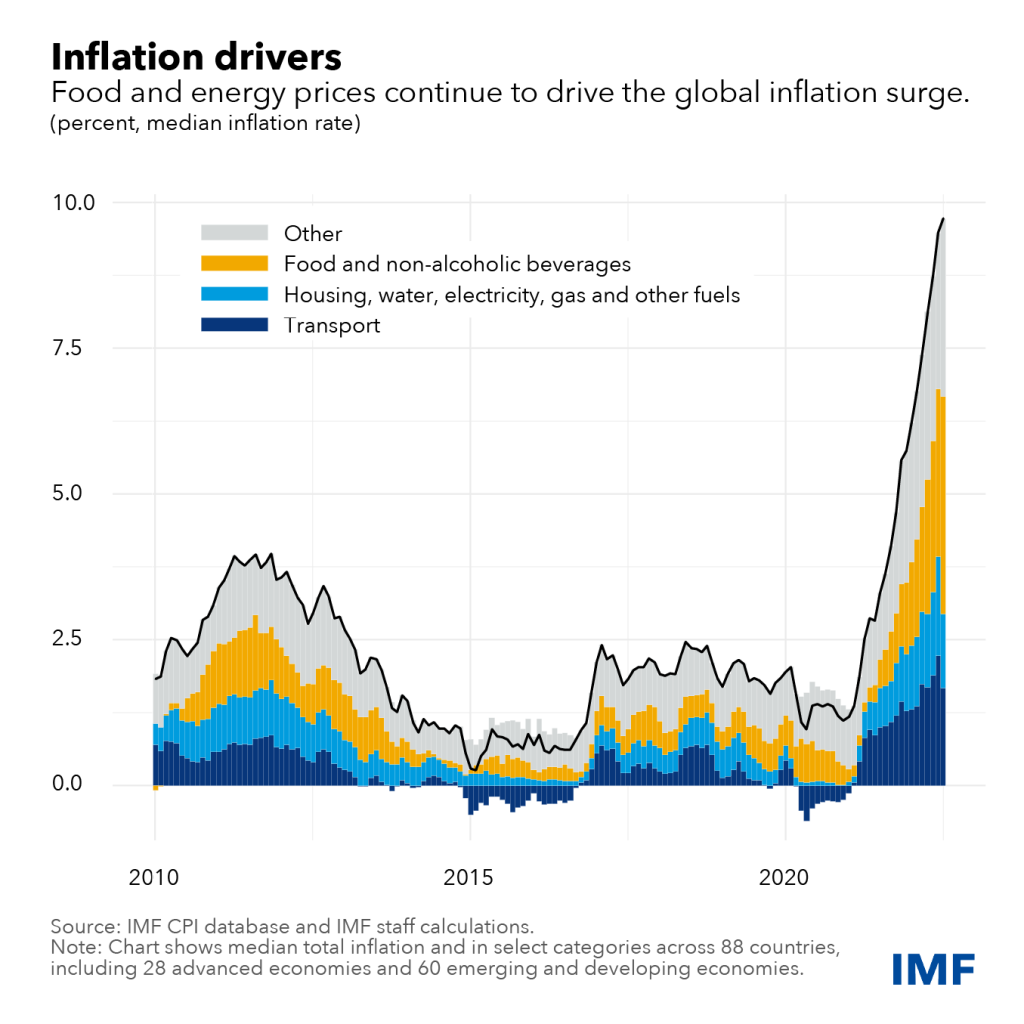

One of the most visible inflation impact is on our grocery bills. The prices of staples like bread, milk, eggs, and meat have been steadily rising in many countries. This isn’t just a minor inconvenience; it forces families to make tough choices, potentially sacrificing healthier options for more affordable, less nutritious alternatives. Supply chain disruptions, increased transportation costs, and even climate-related events contributing to crop failures all play a role in pushing food prices upward. Consumers are actively searching for deals, switching to generic brands, and reducing food waste to stretch their budgets further. Many are also revisiting the idea of growing their own food, even in small urban gardens, to offset some of these rising costs. This pressure on household budgets leaves less money for other essential expenses and discretionary spending, impacting overall economic activity. Even seemingly small increases, when compounded across all grocery items, can significantly strain a family’s finances, especially for those on fixed incomes or with limited resources.

The Inflation Impact on Transportation and Energy Costs

Beyond groceries, the cost of transportation is another area where the inflation impact is keenly felt. Rising fuel prices make commuting to work, running errands, and even visiting family more expensive. This affects not only individual car owners but also businesses that rely on transportation for their operations, leading to increased costs that are often passed on to consumers. Public transportation fares may also increase in response to higher energy costs. Furthermore, the cost of heating and cooling homes has also risen significantly. The price of natural gas and electricity are susceptible to global market fluctuations and geopolitical events, adding another layer of financial strain on households. Consumers are responding by adopting energy-saving measures, such as using programmable thermostats, improving insulation, and switching to more energy-efficient appliances. The increased cost of transportation and energy disproportionately affects low-income households, who may have limited options for reducing their consumption. Some businesses, including those operating on cloud services like AWS or using gb of storage, may also experience increases in operational costs, resulting in increases in the cost of business.

Housing and the Escalating Inflation Impact

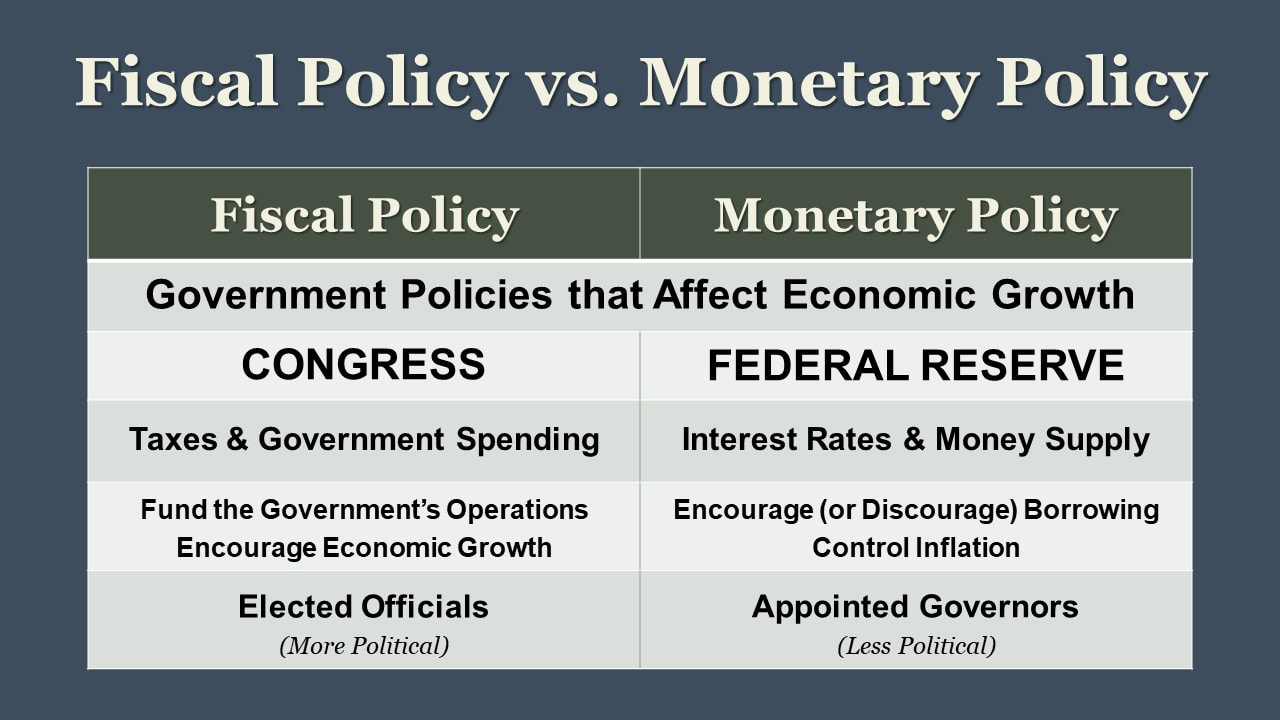

The housing market, whether you’re a renter or a homeowner, is significantly affected by the inflation impact. Rising interest rates, a tool often used by central banks to combat inflation, directly impact mortgage rates, making it more expensive to buy a home. This can cool down the housing market, but it also makes it more difficult for first-time buyers to enter the market. Renters are also feeling the pinch, as landlords often pass on increased operating costs, including higher property taxes and maintenance expenses, to their tenants. In some areas, demand for rental properties is outstripping supply, further driving up rental rates. The affordability of housing is becoming a major concern in many cities, forcing people to move further away from their workplaces or to share accommodation with others. Governments are exploring various policy options to address the housing affordability crisis, including increasing the supply of affordable housing units and providing rental assistance programs.

Managing Your Finances Amidst the Inflation Impact

While inflation presents challenges, there are steps you can take to manage your finances effectively. Creating a detailed budget is essential to track your income and expenses and identify areas where you can cut back. Prioritizing essential spending and reducing discretionary spending can help you stay within your financial limits. Consider negotiating better deals on your bills, such as insurance premiums or internet services. Explore opportunities to increase your income, such as taking on a part-time job or freelancing. Investing in assets that tend to hold their value during inflationary periods, such as real estate or commodities, can also help protect your purchasing power. Financial literacy is key to making informed decisions and navigating the complexities of an inflationary environment. Many online resources and workshops are available to help you improve your financial knowledge and skills. It’s also important to stay informed about economic trends and government policies that may affect your finances.